Off-Grid Long Duration Energy Storage Takes Off

Sites that are off-grid or capable of being off-grid are growing rapidly. From buildings to industrial processes, data centers, desalination plants and islands, they are more likely than grids to adopt a high percentage of solar power and therefore to need energy storage to cover solar dead at night. Increasingly, many must also cope with sun and wind poor for weeks as fossil fuel backup is consigned to the trash bin of history. The new Zhar Research report, “Long Duration Energy Storage LDES beyond grids: markets, technologies for microgrids, minigrids, buildings, industrial processes 0.1-500MWh 2024-2044” describes how this is more than a dream – the orders for the required LDES are flooding in.

Different sector and different winners

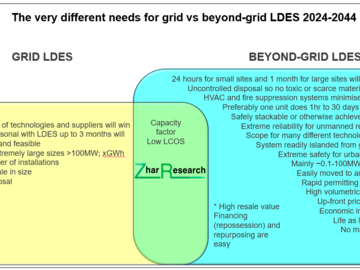

Dr Peter Harrop, CEO of Zhar Research notes,

“The important thing here is that the technologies are different. While most investors and manufacturers are chasing the herd into the grid LDES market, it is already clear that some of their technologies are best repositioned into beyond-grid applications. For example, the fundamentals dictate that redox flow batteries RFB can never be more than an also-ran for the requirements of giant grid LDES. In contrast, they can dominate the emerging market of over $50 billion for beyond-grid LDES. Part of the reason is that beyond-grid sites are too small for massive earthworks. You cannot have pumped hydro or gases in abandoned salt caverns under a factory near you in order to delay its electricity. Even some of the other above-ground options such as advanced conventional construction batteries ACCB, liquid air and liquid carbon dioxide energy storage may have as much opportunity beyond grid as for grids. Careful strategic positioning away from the herd will pay dividends."

Beyond-grid LDES becomes commonplace

A US community energy organisation, Central Coast Community Energy contracted three flow battery projects including one of 16MW/128MWh, 8 hours expected to be operational in 2026. The California Energy Commission (CEC) has made its first payout from a US$380 million fund to support other beyond-grid LDES, committing US$31 million funding for a microgrid project that will pair a 1MW/10MWh 10-hour vanadium reflow battery VRFB with a 35MWh zinc hybrid cathode battery LDES storage system.

Vanadium RFB gets busy

EDF UK and eZinc Canada have UK funding to trial vanadium RFB and ACCB options for a 24-hour storage system of up to 100kW. Bryte Batteries in Norway develops, distributes, integrates and operates sustainable VRFB for industrial and commercial applications. Their biggest customers are within real estate, transportation and land-based fish-farming. Here, the flow batteries are designed for 4, 8, 12 hours and more. VisBlue Norway electrifies Nordic agriculture with its VRFB. In addition, at Skjetlein upper secondary school in Denmark, you can see its 16 kW, 200 kWh 12.5-hour RFB.

Yes, this is global. True to its name, Austria’s CellCube makes self-sufficient VFRB modules. It prudently focuses on the commercial, industrial and microgrid segment of the energy storage market rather than pretend that it can dominate the mainstream grid market. It creates individual storage parks in the 10MW range with duration of up to 24 hours. South Korean VRFB company Korid Energy is deploying a unit at an edge-of-grid mine in Western Australia, with 25 kW / 250 kWh 10 hours duration. Sumitomo Electric in Japan has supplied a 1MW/ 8MWh 8-hour duration VRFB to a recently-established municipal power company in Niigata, Japan. Similarly, VRB Energy in the USA now delivers 8-hour VFRB configurations, from 1MWh to 200MWh.

RFB without vanadium coming up fast

Harrop advises,

“It is not all about the original vanadium form, with its need for recycling valuable metal. Big names such as BASF and Lockheed Martin sell RFBs that do not need vanadium. Their sales can grow even faster than vanadium versions: some are half the size and others are already well-proven in military facilities at 8-10 hours duration. We have projections for them overtaking the fast-growing VRFB beyond-grid sales from 2024-2044. Partly, this will be because the beyond-grid market expands to large numbers of widely-dispersed sites, such as buildings and self-powered vehicle charging stations, where lower costs and uncontrolled disposal are the realities.”

German organic flow battery company CMBlu has won a 5MW, 10-hour pilot with Arizona utility Salt River Project (SRP). It will build, own and operate the project for SRP at the utility’s Copper Crossing Energy and Research Center in Florence, Arizona. This is a new power plant project with a 55MW solar PV plant in phase two then CMBlu’s LDES in phase three. Quino Energy in the USA is developing a redox flow battery targeted for the market moving to 8 – 24 hours of energy storage. It uses the flow battery system itself as the electrolyte production reactor, enabling a new chemistry without a new factory while creating zero chemical waste. Meanwhile, thriving ESS, in the USA, claims cost advantage for 4-12 hours storage with its vanadium-free RFB.

Elestor in the Netherlands is developing low-cost long-endurance RFB technology specifically targetting 24-hour endurance without vanadium. Redflow Energy in Australia has, “Pod200” as its scalable storage solution. It boasts 250 active deployments and over 3 GWh of energy delivered. Its full orderbook now takes duration up from 4 to 12 hours without employing valuable metals.

Other beyond-grid LDES options

Of course, beyond-grid LDES is about more than just RFB. Indeed, currently, most RFB employ toxic materials or intermediaries and there are other issues. 99% of the world’s stationary storage in GWh is from pumped hydro, some rated up to 20 days, so what about a variant of that for smaller sites? Zhar Research is impressed by wild card RheEnergise in the UK, which pumps liquid heavier than concrete up mere hills, out-of-sight. No fade over very long life and almost no self-leakage. What’s not to like? This could well be useful for some of the larger beyond-grid sites such as islands and 100MW desalinators.

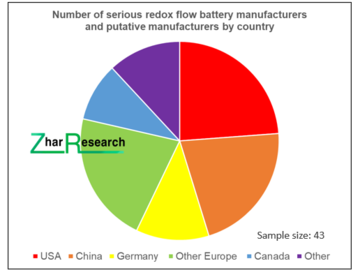

The 377-page Zhar Research report, “Long Duration Energy Storage LDES beyond grids: markets, technologies for microgrids, minigrids, buildings, industrial processes 0.1-500MWh 2024-2044” analyses all the options. www.zharresearch.com. There are profiles and prioritising of 43 RFB manufacturers in 116 pages with appraisal for beyond-grid LDES achievements, intentions and potential but also eleven of the most promising ACCB and liquid gas LDES companies and many others are profiled and compared. Roadmaps and 26 forecast lines give the outcome.

Press release distributed by Pressat on behalf of Zhar Research , on Wednesday 15 November, 2023. For more information subscribe and follow https://pressat.co.uk/

Ldes Off-Grid Energy Green Energy Energy Storage Environment Long Duration Energy Storage Microgrids Minigrids Industrial Solar Hydro Business & Finance Consumer Technology Education & Human Resources Environment & Nature Manufacturing, Engineering & Energy Opinion Article

Published By

anastasiams@zharresearch.com

https://www.zharresearch.com/

Dr Peter Harrop

peterharrop@zharresearch.com

Visit Newsroom

You just read:

Off-Grid Long Duration Energy Storage Takes Off

News from this source: