New Report on the Emerging $230 billion Market for Battery-Free Electricity Storage

- SWOT appraisals 6

- Chapters 8

- Forecast lines 2024-2044 31

- Infograms, tables, graphs 143

- Companies 225

- Pages 429

A huge new market for materials and hardware awaits you in the new Zhar Research report, “Battery-free electrical energy storage and storage elimination milliWh-GWh: markets, technologies 2024-2044” at 429 pages. There is a glossary at the start and terms are explained throughout the report.

Market needs often moving beyond what batteries can achieve

The next 20 years will see the widespread deployment of laser pistols, large laser cannon, many new aerospace and medical pulse technologies, fast-response emergency power, months-to-seasonal solar grid storage, hydrogen high-speed trains, maybe some thermonuclear power. Battery-free energy storage will be essential to all of them, mainly because batteries can never provide the required pulse power, minimal self-leakage, GWh economy or longest life due to their fundamental chemistry. For example, the largely physics-based approach of battery-free storage variously provides one hundred times the power density, zero self-leakage, one tenth of the GWh Levelised Cost of Storage LCOS and/or 100-year life. Indeed, it is typically non-flammable, with no toxicity or scarcity issues.

Massive growth in battery-free storage as needs change

Batteryless storage technologies are on a trajectory way beyond today’s $25 billion business of pumped hydro for grids and the $4 billion business of supercapacitors and capacitor banks. This is a world that includes lifting weights, compressing gases, chemical intermediaries and making supercapacitor derivatives, with most of those already landing first large orders for delayed electricity. Add pumped hydro reinvented and niches like electrical flywheels and thermally delayed electricity.

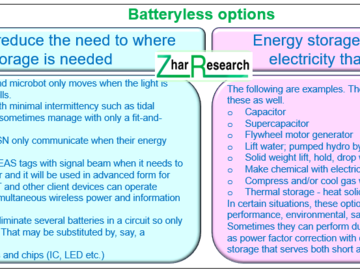

Large market emerging for storage elimination technology

Storage elimination is also covered including planned 6G Communications powering powerless IoT nodes only when interrogated, solar farms making chemicals when operative and the lizard-like microbot moving when light is available. Some Wireless Sensor Network nodes communicate when their multi-mode energy harvesting has enough input – which can be often, thanks to the new ultra- low power electronics needing only a whisper of electricity.

Lithium-ion batteries do not escape the S curve

The Zhar Research facts-based analysis finds that lithium-ion battery sales are not immune to the S curve. They will saturate at around $330 billion as we approach 2044 because of new batteries, decline of their major applications and inability to serve those huge new batteryless markets. Later on the S curve, your around $230 billion batteryless storage opportunity and your market for storage elimination technology will both be growing increasingly rapidly in twenty years from now. Learn how to create a multi-billion-dollar hardware business out of that, including gaps in the market, potential acquisitions, partners and best pickings from the research pipeline.

What is offered in the new report

The Executive Summary and Conclusions at 37 pages is sufficient for those with limited time. Here are the basics, methodology, 22 key conclusions, roadmaps 2024-2044 and the 31 forecast lines 2024-2044. Many new infograms make it easy reading. See SWOT appraisals: one of battery-free technologies and one of storage elimination.

Chapter 2 Introduction has 10 pages covering megatrends of electrification, battery adoption and battery elimination, pressures on batteries 2024-2044, Information and Communication Technology ICT power issues including 6G, WPT, WIET, SWIPT, Internet of Things and its power problems and solutions. Understand the trend to 100% zero-emission renewable power and increased intermittency of supply from more wind/ solar. Understand renewable energy by country and its effect on Long Duration Energy Storage LDES choices. Here is the batteryless storage toolkit from options with little growth potential - inductor, conventional capacitor, flywheel - and those with major growth potential: supercapacitors and their variants and the heavy engineering options.

Chapter 3 “Wireless electronics and electrics battery elimination” takes 40 pages, including a SWOT appraisal, to explain these aspects in more detail. Highlights include the trends to self-powered sensors, passive repeater antennas, metamaterial passive 6G reflectors, backscatter – EAS and passive RFID then more sophisticated forms, wireless information and energy transfer WIET for 6G and IOT, even wireless Internet of Everything IoE from forthcoming 6G. Here are energy harvesting with demand management to reduce or eliminate storage and detail on battery-free electronics: sensors, phones, cameras, small drones, self-powered sensors and also sensors and biometric access by harvesting man-made radiation. Understand the contribution of those ultra-low power circuits, the new intermittency-tolerant electronics and battery-free power electrics, even vehicle charging direct from solar.

The 19 pages of Chapter 4. “Strategies for fewer and smaller batteries” explores intermittency issues and solutions including Battery Elimination Circuits BEC and both multi-mode and multi-source energy harvesting. The 24 pages of Chapter 5 “Energy harvesting μW to GW for battery reduction and elimination in 6G, IOT, wearables and other systems” are also an easy read, again with the priority being business opportunities not nostalgia or academic obscurity. You are now sufficiently warmed up to absorb the heroic deep-dive chapters.

Chapter 6 “Capacitors, supercapacitors, pseudocapacitors, lithium-ion capacitors” takes 133 pages to explain why these will sell at 7.5 times the 2024 level in 2044. Clue: much of that projection comes from new market needs that call for their particular attributes. They are appearing in aircraft, aerospace, electric vehicles, microgrids, grids, for peak shaving, renewable energy, uninterrupted power supplies, medical, wearables, military such as the new pulsed linear accelerator weapons, radar and trucks. Add power and signal electronics, data centers and welding all with subsections here.

See the spectrum of choice and latest research pipeline separately for pure supercapacitors, many hybrid approaches and pseudocapacitors. That prepares you for the coverage of actual and potential major applications of supercapacitors and their derivatives and the very detailed comparison of 103 supercapacitor companies assessed in 10 columns with a profusion of illustrations.

Chapter 7 “Large capacity battery-free storage for 6G/IOT base stations, data centers, buildings, microgrid and grid Long Duration Energy Storage LDES” is also a very deep dive. Its 140 pages are necessary because this heavy end, mainly MWh to GWh, is going to grow eightfold to around $200 billion in 2044. Mostly, that is because so many microgrids and grids will progress to highly intermittent solar and wind power because of dramatic cost advantages even allowing for the added need for storage. 50-100% adoption in a given system demands months to seasonal storage that batteries can never provide competitively. Because it has the largest potential market, LDES takes most of this chapter with six SWOT appraisals, roadmaps and parameter comparisons as tables and infograms comparing everything from hydrogen intermediary to thermal for delayed electricity, including how they will improve. Most detail is on those assessed to be particularly promising for growing the market, including compressed air, liquid air or carbon dioxide, lifting solid weights, pumped hydro reinvented. See parameters, costings, competitors, technologies and targets.

Hydrogen has a place

Hydrogen is an important part of this story, from Chinese supercapacitor-hydrogen high-speed trains demonstrated in 2023 to hydrogen storage in salt caverns proposed for the UK and elsewhere for months-to-seasonally delayed electricity. Although hydrogen storage is covered in Chapter 7, the brief Chapter 8 gives the bigger picture of “The proposed hydrogen economy and its use for delayed electricity” in seven pages, mostly detailed infograms, to close the report.

Be inspired

We therefore trust that you will then be sufficiently inspired and informed to consider making a multi-billion-dollar hardware business out of some of this. Zhar Research report, “Battery-free electrical energy storage and storage elimination milliWh-GWh: markets, technologies 2024-2044” is your essential reading.

Press release distributed by Pressat on behalf of Zhar Research , on Thursday 19 October, 2023. For more information subscribe and follow https://pressat.co.uk/

Batteries Battery-Free Battery-Less Electrical Energy Storage Energy Technology 6g IoT SWIP LDES Robotics Aerospace Medical Microgrids Computing & Telecoms Consumer Technology Education & Human Resources Manufacturing, Engineering & Energy Medical & Pharmaceutical Opinion Article

Published By

anastasiams@zharresearch.com

https://www.zharresearch.com/

Dr Peter Harrop

peterharrop@zharresearch.com

Visit Newsroom

You just read:

New Report on the Emerging $230 billion Market for Battery-Free Electricity Storage

News from this source: