COINSHARES GROUP - NOW REPRESENTING OVER $1BN IN CRYPTO ASSETS - ANNOUNCES TWO NEW FLAGSHIP FUNDS

We are particularly excited for these two new funds as they represent the latest evolution of our expertise.

LONDON, ENGLAND, JANUARY 23, 2018 — CoinShares Group, the group behind the first bitcoin and ether exchange traded notes (Issued by XBT Provider AB) and the team behind the world’s first regulated bitcoin strategy (GABI), is announcing two new flagship crypto investment funds today.

The two funds: CoinShares ‘Active’ Fund - a multi-coin, alpha-generating, active strategy; and CoinShares ‘Large Cap’ Fund - a passive, large-cap, basket fund; represent a natural evolution of market approaches based on the current trajectory of the crypto-asset economy.

This announcement follows the group’s October launch of the first Ether Tracking, Exchange Traded Products on Nasdaq Stockholm. These ETPs now comprise more than $350M of assets less than 4 months post launch.

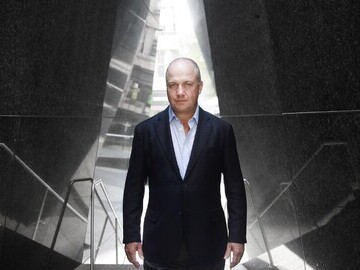

“As a group, we have developed a deep expertise in bringing new, fit-for-purpose crypto-investment products to market; products which offer traditional investors proper, familiar channels to access the crypto-asset ecosystem. We are particularly excited for these two new funds as they represent the latest evolution of our expertise and are built on key learnings from the last three years of managing crypto-asset investments,” says Daniel Masters, Chairman of CoinShares group of companies.

In addition to announcing two new funds, the CoinShares Group is also officially announcing the opening of a London-based office. CoinShares is seeking to establish itself in jurisdictions where crypto regulation is evolving and will work with regulators in this area.

“We are excited to establish the appointed representative relationship with Sapia Partners LLP, part of the Lawson Conner Group. As one of the European leaders in crypto-finance, we have a responsibility to lead by example; and as a group we believe that the crypto-finance community should seek more regulation, not run away from it; this London office is a proper step in upholding that belief. There is still a lot of work to be done on regulation in crypto-finance and we look forward to working with regulators throughout the process,” says Ryan Radloff, CEO, CoinShares (UK).

For more information on the new funds or other CoinShares related inquiries, please email info@coinshares.co.uk.

###

CoinShares Group is the European leader in crypto-finance with over $1 billion in crypto-assets across a suite of exchange traded and private investment products. The group of companies serves a global investor base seeking to invest in the emerging crypto asset market(s) with a family of products which offer exposure to bitcoin and other emerging digital currencies/assets. The CoinShares’ product line-up comprises a group of offerings which all represent first of their kind products: Bitcoin Tracker One (and Bitcoin Tracker Euro) and Ether Tracker One (and Ether Tracker Euro) the first exchange traded bitcoin and ether products, globally; and CoinShares Fund 1 – the first fund denominated in cryptocurrency (ETH). CoinShares is backed by a team with deep experience in Exchange Traded Products, Hedge Funds, Commodities, FX, Market Making and both active and passive investment in frontier markets.

CoinShares (UK) Limited is an appointed representative of Sapia Partners LLP, which is authorised and regulated by the Financial Conduct Authority (FRN: 550103). This document has been prepared and issued by CoinShares (UK) Limited and is being provided for information purposes only. It is not intended as an offer or solicitation to enter into any proposed transaction or investment.

Investors’ capital is at risk, and investors should only invest if they are able to afford the loss of all capital invested. There is no guarantee that the investment objectives will be achieved and past performance should not be construed as an indicator of future performance.

Crypto-currencies can be extremely volatile and subject to rapid fluctuations in price, positively or negatively. Investment in one or more crypto-currencies may not be suitable for even a relatively experienced and affluent investor. Each potential investor must make their own informed decision in connection with any such investment (after having sought independent financial advice thereon).

Press release distributed by Pressat on behalf of , on Tuesday 23 January, 2018. For more information subscribe and follow https://pressat.co.uk/

Bitcoin Fund Hedge Fund Asset Management Crypto Currency Cryptocurrency Cryptoasset Btc Eth Blockchain Altcoin Crypto Fund Business & Finance Crypto Currency

Published By

You just read:

COINSHARES GROUP - NOW REPRESENTING OVER $1BN IN CRYPTO ASSETS - ANNOUNCES TWO NEW FLAGSHIP FUNDS

News from this source: