Ex-Goldman Banker to Take on 400 Year Old Wealth Management Industry

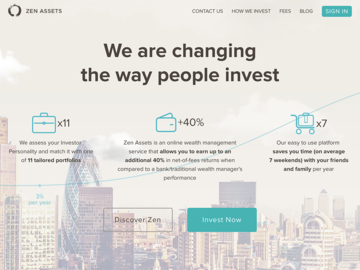

London, 10th February 2015. Zen Assets, a UK online wealth management firm established by a former Goldman Sachs banker, is entering the market to offer investors better net-of-fee returns and provide services to clients traditional wealth management ignores.

The firm offers six benefits to investors: innovative advice from a team with a 30-year combined track record in asset management, significantly lower investment fees, an easy-to-use online platform, an Investor Personality Assessment, historical performance via a "Time Machine" and full control over clients' portfolios.

"By integrating these elements into one simple platform we are changing the way people invest. We study in detail our clients' risk tolerance before proposing a tailored portfolio. Zen Assets is about helping people make informed investment decisions with ease and confidence," said Oksana Johannesson, 30, Zen Assets' Chief Operating Officer and a former Samsung Global HQs executive.

"Our business model targets young, affluent professionals with at least £10,000 to invest. In the UK alone we estimate this market to be around one million people – individuals ignored by traditional wealth managers. On top of that recent regulatory changes are forcing banks and independent financial advisors (IFAs) to abandon clients with less than £100,000 to invest because they cannot service them efficiently."

As the debate over the global polarisation of wealth heats up, one thing is certain: more people are becoming wealthy. In the UK there are £2.5 trillion in investable assets, but the returns on these assets are not maximised due to the following roadblocks:

a)Excessive paperwork and operational inefficiencies;

b)Lack of transparency/conflicts of interest when advisors select fund managers;

c)High investment fees and commissions: up to 70% of investors' real returns could be swallowed up in charges;

d)No financial advice for clients with less than £100,000: the only options are online brokers or investment product supermarkets.

Zen Assets removes these roadblocks.

The firm begins by studying potential clients' risk-tolerance at https://zenassets.com/ before proposing a portfolio. Clients do not have to invest real money up-front – they can enter a "Time Machine" section to see how their chosen portfolio would have performed – based on historical data – had they invested at any time over the past 15 years. In other words a portfolio is back-tested based on risk appetite. Clients can have real-time portfolio updates by logging in to their account. If they are still unsure they can choose a virtual portfolio and monitor its performance as long as they want – or until their financial education gives them the confidence to invest real money.

Currently a typical UK wealth manager charges on average 3.65% per year (and in some cases as much as 7.5%) to manage clients' money. Zen Assets aims to deliver an additional 40% in net-of-fee returns over a 10-year investment period by reducing the cost of investing. Zen Assets' clients only pay 0.5% in advisory fees and about 0.16% in ETF and trading fees of their portfolio value per year. Such deep cuts in fees are possible as overheads are minimal and efficiency is high.

In addition to low fees Zen Assets offers investors an attainable entry level - initial investment is £10,000. Clients can open an account in three days and start investing right away, instead of waiting up to a month if going to a bank. They can sell their portfolio and withdraw money within one working day if needed.

"Recently the FT published an article stating that in 2014 about 90% of US active managers underperformed their benchmarks," says Zen Assets founder and former Goldman Sachs' Executive Director Sergey Sosnov, 37. "Why would you give your money to an expensive active manager who can hardly compete with a market index? In addition, many wealth managers charge their clients fees to select fund managers who can't deliver in the first place. Expensive managers, costly execution, custody fees - all this eats into clients' portfolio returns. We started Zen Assets to cut the clutter that impacts investment results, to make investing less stressful and to save our clients' time."

"Traditional players stress the importance of building strong personal relationships with their clients. In reality, wealth managers often have far too many clients to serve them well and still be profitable. The widely promised personalised approach is practically non-existent, especially for clients with less than several million pounds. Clients are more likely to end up with a one-size-fits-all approach, despite paying high fees," emphasised Sergey Sosnov.

"Our main focus this year is a fast growth of assets under management (AUM). Zen Assets' investment team has developed an Investor Personality Test, which allows us to define the level of risk tolerance and propose 11 different portfolios to our clients. You could call this a digital platform with a human touch. I believe the digitalisation and democratisation of private wealth management will increase the number of clients exponentially in the next few years," added Oksana Johannesson.

Zen Assets' investment team has more than 30 years of combined investment experience and has managed over $1.2 billion in client funds.

Press release distributed by Pressat on behalf of Zen Assets, on Tuesday 10 February, 2015. For more information subscribe and follow https://pressat.co.uk/

Best Invest Asset Management Annuity Rates Compare Savings Rates Wealth Management Financial Planning Hedge Fund High Interest Savings Business & Finance Consumer Technology Personal Finance

Published By

+44 (0) 203 289 10 0

o.johannesson@zenassets.com

https://zenassets.com/

CEO & Founder - Sergey Sosnov

+44 (0)78 2628 9753

sergey@zenassets.com

Visit Newsroom

You just read:

Ex-Goldman Banker to Take on 400 Year Old Wealth Management Industry

News from this source: