European Central Bank to Respond to Latest Data from a Dismal Month

The Eurozone moved a step closer to deflation as the inflation rate fell from 0.4% in July to 0.3% in August. Unemployment remained static at 11.5% for July, completing a month of dismal economic news for the currency bloc. Thursday saw the economic sentiment indicator fall from 102.1 for July to 100.6 for August, where 100.0 represents the long-term average.

Nationwide Bank released house price data showing that UK prices had risen by 0.8% month-on-month during August, challenging earlier signs that the housing market had started to cool. The annual rate of house price inflation rose to 11.0% on the index. However, other data such as mortgage approvals broadly support the view that the market is slowing, and Cebr expects house price inflation to ease throughout the remainder of 2014.

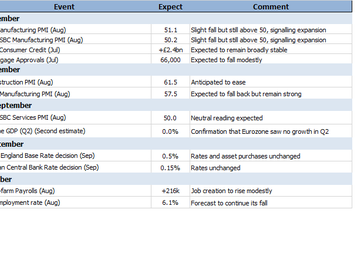

This week

The European Central Bank's response to last week's round of data will be clarified by Thursday at a press conference. Markets are now increasingly convinced that the European Central Bank will finally make use of an asset purchase scheme, also known as quantitative easing, to turn around the stagnation currently gripping the bloc. Draghi took the opportunity of the annual central bankers' forum at Jackson Hole to hint that a more accommodative monetary stance would be necessary. Draghi's past form of influencing markets through words means that he may well leave it at that for now; the ECB is also waiting to see how the long-term refinancing operation, announced in June, will turn out once it commences. However, quantitative easing is highly likely before the end of the year.

The Bank of England will also set the base rate and asset purchase facility for September. Last month's minutes revealed that for the first time in three years, the committee had been split on the interest rate decision. However, just two members of the nine voted for a rise, so Cebr expects there will be no change this month.

Press release distributed by Pressat on behalf of Pressat Wire, on Monday 1 September, 2014. For more information subscribe and follow https://pressat.co.uk/

Business & Finance Personal Finance

You just read:

European Central Bank to Respond to Latest Data from a Dismal Month

News from this source: