£900m Return on Financial Education for Care Leavers & NEETS - MAS Study

Problem debt costs UK taxpayers £248m and wider society £900m annually.

Debts down, savings up

Intervention “elevates playing field” for UK’s vulnerable young adults - Independent yearlong study

£874m in social value could be generated by giving the UK’s most vulnerable young people access to expert-led financial education, a charity has claimed after an independent report of their work.

Evaluators, ERS, spent a year examining the impact of ‘survival’ money management workshops on over a thousand 16-25 year old NEETS and care leavers, who on average are more likely to be in poverty and have problem debt.

The study showed:

- £1 spent on the programme created £5.57 in social value and the impact increased as time went on.

- Average debts of £300 dropped 60% to £120. This compared to control groups of their peers, who saw their average debts grow by 50%.

- The number saving money regularly increased by 23%.

- Capabilities of young people in saving, financial confidence, life satisfaction and digital literacy, which were below the national average, are now above it.

Using the respected Housing Association Charitable Trust social value model, the £156m cost of providing the UK’s 800,000 Neets and 10,000 annual care leavers with financial education is outweighed nearly six times over - reducing debts, increasing savings and alleviating financial burdens.

Legal duty - Investing in young people

This year, the Children and Social Care Act placed a legal duty on local authorities to protect young care leaver’s economic wellbeing and ensure access to financial information. In 2016 The Children’s Society found that almost half of councils in England fail to offer these services.

ERS’ findings strengthen the case for providing trained expert money guidance for vulnerable young people, which is backed by reports from the All Party Parliamentary Groups on Financial Education for Young People, and on Ending Homelessness, and the Mayor of London.

The National Audit Office found problem debt is costing UK taxpayers £248m and wider society £900m per year. 18-24 year olds have average unsecured debts of £1,460 and are the UK’s fastest growing group of debtors, according to the Financial Conduct Authority. They are also the most susceptible in society to fraud and scams, says the Policy Network.

MyBnk’s Money Works course covers independent living, digital finance skills and debt prioritisation. It tackles topics such as budgeting and habits, the financial system, borrowing, how taxes, banking and benefits work, and accommodation. Sessions were delivered by MyBnk via councils leaving care units and employability programmes run by organisations such as Princes Trust and Premier League Works.

The research was funded by the Money Advice Services’ £12m ‘What Works’ Fund: a two-year investment programme designed to test and pilot potential new financial capability solutions, scale up interventions and evaluate existing projects across the UK. It evaluated Money Works’ programmes’ theory, outcomes, causality and value for money.

National Averages

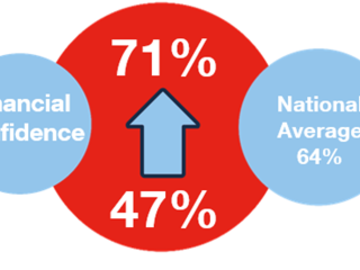

MyBnk found vulnerable young people were below the national average for their peers across a range of indicators, but after intervention, exceeded their more capable peers in the long term:

- Life satisfaction increased by 28%.

- There was a 24% improvement in financial confidence.

- More now go online to make government transactions, such as paying tax, than the national average – boosting digital literacy.

It may also be more effective to direct resources outside of London. ERS discovered a greater social return on investment of £8.19 for every £1 versus £4.05 in the capital. The programme therefore helps those most in need, as young people outside London were found to have lower financial capabilities. Money Works closes this gap.

Quotes

Guy Rigden, CEO, MyBnk said: “Working with vulnerable young people at these transitional periods is crucial. That’s when they are at the highest risk of making the poor financial decisions that can have lifelong consequences. Social and key workers are under immense time and resource pressures to meet the need. These results, show investing in young people and the use of expert-led direct delivery of these specialist areas pays back for everyone. The improvements against the national averages proves Money Works doesn’t just level the playing field for vulnerable young people, it can elevate it for all.”

Sarah Porretta, UK Financial Capability Director at Money Advice Service said: “Money Works is an excellent example of providing young care leavers with the skills and knowledge they need to manage their money and stay out of problem debt. By providing care leavers with the awareness and confidence to seek advice, the programme has made strides in helping them with their transition to independent living. The findings from this programme will undoubtedly inform the practice and delivery of young people’s financial education.”

Keith Burge, Managing Director, ERS said: “As with all subjects of our research, we applied rigorous assessment to both the qualitative and quantitative aspects of this study. Having done so, it is very gratifying to see such positive outcomes. The values generated by Money Works are testimony to the quality of the intervention which is clearly having a major impact on the lives of the young people concerned.”

Notes to editors

Case studies

Evaluation data:

- Sample: 1,243 individuals.

- Control groups: 343.

- National averages: Money Advice Service UK adult Financial Capability Survey, 2017.

- HACT Social Value model.

- Executive Summary - Full report – Appendix.

Social value calculations:

- £1 spent = £5.57 social value.

- Cost of one Money Works programme = £1,550.

- 8 people on average go through one programme.

- 8 ÷ 800,000 NEETS + 10,000 annual care leavers = 101,250 programmes.

- 101,250 x £1,550 = £156,937,500 total cost.

- £156,937,500 x £5.57 = £874,141,879 social value.

Endorsing reports:

- The Children’s Society – Cost of Being Care Free.

- Mayor of London – Short Changed.

- APPG for Ending Homelessness – Homelessness Prevention.

- APPG on Financial Education for Young People – Vulnerable Young People.

Programme delivery funded by

- Comic Relief.

- John Lyon's Charity.

- London Stock Exchange Group.

- Lloyds Banking Group.

- Money Advice Service.

- MUFG Bank

- Players of People's Postcode Lottery.

- Quilter Foundation.

- RBS Innovate.

- Standard Life.Wellington Management Foundation.

About MyBnk:

MyBnk is a UK charity that delivers expert-led financial education programmes to 7-25 year olds in schools and youth organisations.

Together with young people, they have created innovative, high impact and high energy workshops that bring money to life. MyBnk covers topics such as saving, budgeting, public finance, social enterprise and start-up entrepreneurship. Alongside delivery, they also design projects and training programmes. Since 2007 they have helped over 220,000 young people learn how to manage their money in 1,300 schools and youth organisations.

About the Money Advice Service’s What Works Fund:

As a core part of its work supporting the Financial Capability Strategy for the UK, The Money Advice Service launched the £12 million What Works Fund in 2016 to establish the most effective ways of helping different groups manage their money, and find out what works to increase financial capability. In its initial phase, the Fund awarded grants to 65 pilot projects across the UK, directly impacting over 40,000 people. The impact of these projects is being evaluated, so that lessons learned can be used to increase effectiveness, attract funding, and scale up interventions to help millions of people across the UK. This evidence is available on the Money Advice Service Evidence Hub, a focal point for organising and sharing financial capability evidence and insight.

About ERS:

Now in its 25th year of trading, ERS is a highly respected economic research consultancy, employing 18 people in offices in Bristol and Newcastle. The company undertakes a variety of economic and social research studies for government departments, non-departmental public bodies, local enterprise partnerships, local authorities, universities/colleges and a range of third sector organisations.

For more information, pictures, or to visit a MyBnk session please contact declan@mybnk.org or call 020 3581 9920

Press release distributed by Pressat on behalf of MyBnk, on Monday 22 October, 2018. For more information subscribe and follow https://pressat.co.uk/

Debt Young People Vulnerable Care Neet Unemployment Money Personal Finance Local Authorities Councils Local Government Financial Education Business & Finance Charities & non-profits Children & Teenagers Education & Human Resources Government Personal Finance

You just read:

£900m Return on Financial Education for Care Leavers & NEETS - MAS Study

News from this source: